mr.COOPER

sWAG

The redesigned WAG (Workflow Assessment Guide) tool is a streamlined, intuitive interface that guides users through income assessment for real estate financial transactions. Tailored to accommodate various income types, it dynamically adjusts logic and documentation requirements based on user input.

For Mortgage Bankers and Loan Officers, the tool accelerates the pre-approval process by clarifying what documentation is required and reducing errors in income interpretation. It improves confidence in initial borrower assessments and speeds up client onboarding.

For Underwriters, the tool standardizes submissions, reducing inconsistencies and rework. It ensures that all necessary documents are submitted correctly the first time, supporting faster and more accurate underwriting decisions.

Overall, the WAG tool improves efficiency, compliance, and communication across the lending workflow.

A project working with Mr. Cooper Mortgage

The Problem

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Defining the Project

The WAG (Workflow Assessment Guide) redesign project aimed to address inefficiencies in how Sales Associates assess borrower income during the mortgage process. The existing tool, or overall sales intake process, was rigid, lacked contextual guidance, required multiple screens and even multiple software which incurred created frequent documentation errors that impacted downstream workflows for Mortgage Bankers and Underwriters. Using a design thinking approach, we defined key pain points through stakeholder interviews, usability audits, and job shadowing sessions. We then rapidly prototyped a dynamic, user-guided interface in Figma that adapts based on income type and decision logic. There is even a futuristic AI componnt that guides the user from start to finish. Through iterative testing with end users, the new WAG tool demonstrated improved clarity, reduced error rates, and a more streamlined experience for all roles involved in the lending pipeline.

Timing

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Project Duration

Software & Technology

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Tools Used

12

3

Weeks

Weeks

Weeks

3

5+

Iterations

Screens

FIGMA

HTML

HTML

HTML

CSS

HTML

PS

CSS 3

Designer: Lawrence Elliott

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Role & Responsibilities

- User Research

- UX/UI Design

- High Fidelity Prototyping

- Testing

- Front End Development

- Testing

Personas

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Uderstanding The User

MARCUS

Ally Merrill

Age 35

Owner. Be Moved Marketing

MORTGAGE BANKER

Ally Merrill

Age 35

Owner. Be Moved Marketing

Age/Gender: 40, Male

Role: Senior Mortgage Banker

Experience Level: 15+ years in mortgage sales

Ally Merrill

Age 35

Owner. Be Moved Marketing

Behaviors: Juggles multiple applications and systems during client interactions.

Relies on speed and confidence in his tools to maintain high close rates.

Values clarity and automation in repetitive tasks.

Goals: Quickly assess borrower eligibility during pre-qualification.

Instill trust in clients with fast, accurate feedback.

Minimize file rework or rejection due to documentation gaps.

Pain Points: Ambiguity in what documents are required for complex income types.

Time lost seeking clarification from Underwriters.

Tool logic doesn’t adapt well to edge cases (e.g., self-employed borrowers).

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

SANDRA

Ally Merrill

Age 35

Owner. Be Moved Marketing

LOAN OFFICER

Ally Merrill

Age 35

Owner. Be Moved Marketing

Age/Gender: 45, Female

Role: Loan Officer – Residential Lending

Experience Level: 20+ years in the industry

Location: Suburban market, family-oriented clientele

Ally Merrill

Age 35

Owner. Be Moved Marketing

Behaviors: Works closely with clients to collect documents.

Prefers to follow a checklist but needs room for professional judgment.

Appreciates tools that build trust through transparency.

Goals: Ensure complete and compliant loan applications from the start.

Guide borrowers confidently through income verification.

Reduce back-and-forth with Underwriting.

Pain Points: Frequent document corrections requested post-submission.

Lack of inline guidance when dealing with non-traditional income types.

Frustration with tools that use rigid or generic workflows.

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

ALANA

Ally Merrill

Age 35

Owner. Be Moved Marketing

UNDERWRITER

Ally Merrill

Age 35

Owner. Be Moved Marketing

Age/Gender: 28, Female

Role: Mortgage Underwriter

Experience Level: 4 years, specializing in income analysis

Location: Centralized operations hub

Ally Merrill

Age 35

Owner. Be Moved Marketing

Behaviors: Analyzes documentation meticulously under tight deadlines.

Frequently communicates with Loan Officers to resolve gaps.

Relies on consistency in submissions to maintain productivity.

Goals: Review applications quickly with minimal clarification needed.

Ensure compliance and accuracy in documentation.

Reduce the time spent correcting incomplete or inconsistent submissions.

Pain Points: Repeatedly receives files with missing or incorrect income documentation.

Must interpret vague submission notes or incorrectly selected income types.

Workload spikes due to resubmissions and clarification loops.

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

“I want my team to confidently assess borrower income, submit accurate and complete files, and reduce delays caused by documentation gaps or miscommunication. We need a tool that adapts to different income types, provides clear guidance, eliminates redundant back-and-forth with underwriting, and supports real-time validation—so we can focus less on fixing errors and more on serving clients efficiently and compliantly.”

User Research

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Analyzing User Needs and Activity

USABILITY AUDITS

Ally Merrill

Age 35

Owner. Be Moved Marketing

JOB SHADOWING / STAKEHOLDER INTERVIEWS

Ally Merrill

Age 35

Owner. Be Moved Marketing

As part of the WAG tool redesign, we conducted a comprehensive research phase involving stakeholder interviews (12 participants across Sales, Underwriting, and Operations), three full-day job shadowing sessions with Loan Officers and Underwriters, and usability audits across five regional branches. From this research, we discovered that 78% of Mortgage Bankers struggled with unclear documentation rules for variable income types, leading to delays in pre-qualification. Loan Officers reported that nearly 60% of their files required rework due to missing or misclassified income documentation, often caused by a lack of real-time guidance within the tool. Underwriters noted that 1 in 3 submissions required clarification, resulting in prolonged decision cycles and increased workload. Each group faced unique pain points: Mortgage Bankers needed faster, clearer income assessment logic; Loan Officers required adaptive workflows and inline documentation checklists; and Underwriters sought standardization and submission accuracy. The redesigned tool directly addresses these issues through dynamic, income-specific guidance, visual workflow clarity, and front-loaded validations. Based on user testing, we project a 40% reduction in submission errors, a 30% decrease in back-and-forth clarification requests, and up to 25% faster loan processing times.

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

Old System Assessment

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

New System Assessment

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

78%

3

Found difficulty in the old system

Weeks

Weeks

60%

3

Rework Required

Weeks

Weeks

25%

3

Faster Loan Processing Times

Weeks

Weeks

40%

3

Reduction in Submission Errors

Weeks

Weeks

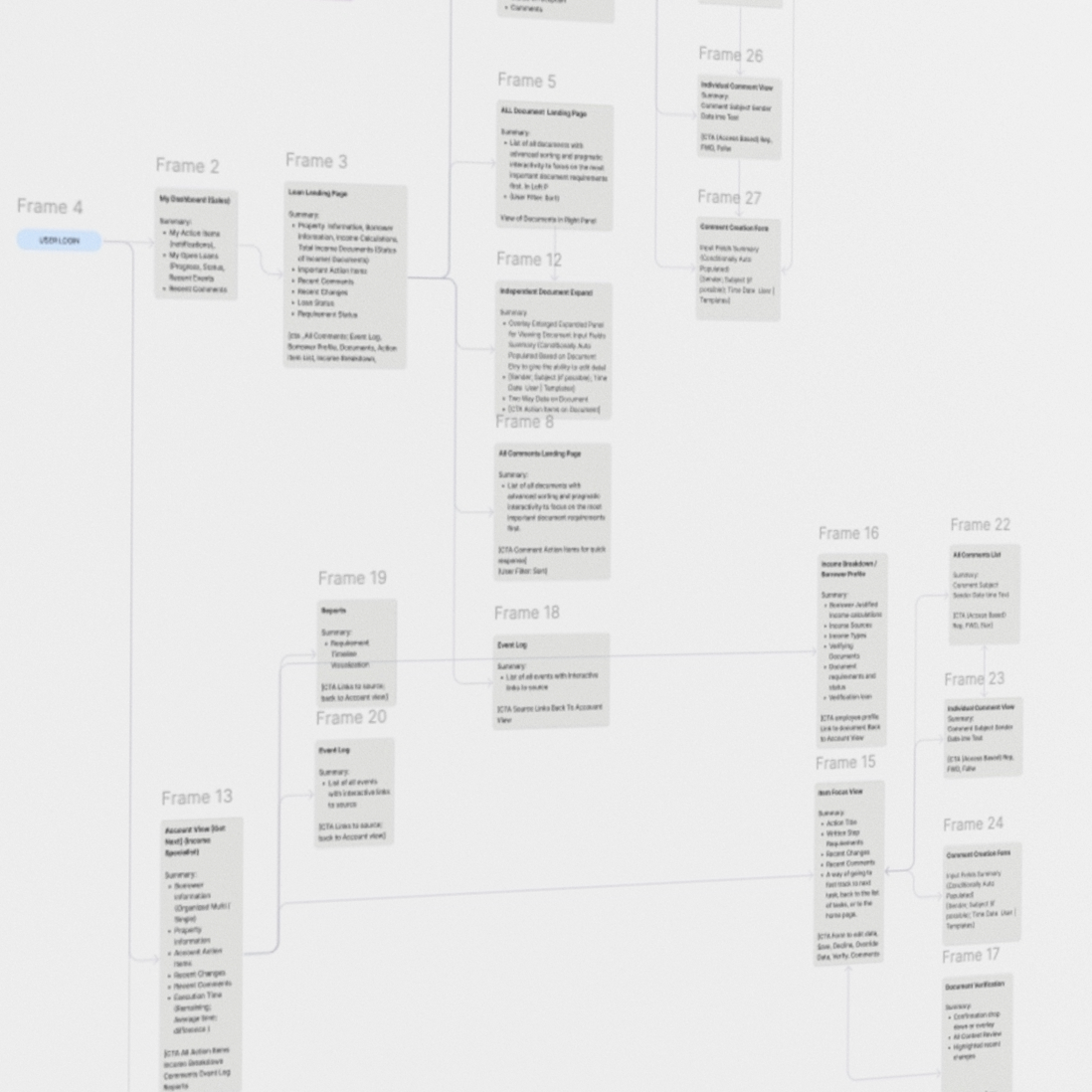

App Definition

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

A Powerful Flow Dynamic

The new user flow in the redesigned WAG tool was built to eliminate friction and confusion by aligning the interface with the actual mental model and task sequences of Sales Associates, Loan Officers, and Underwriters. Previously, the process was linear and static—requiring users to navigate step-by-step through irrelevant fields or guess at next actions, especially when dealing with varying income types. This often resulted in delays, misclassifications, and excessive backtracking.

In contrast, the new flow is dynamic, role-aware, and context-sensitive. From the initial entry point, users are guided through only the relevant paths based on selected income types, document presence, or borrower profiles. Key decision points now trigger adaptive prompts, and the tool intelligently surfaces the most likely next actions using built-in logic and heuristics. The experience begins with a high-level account summary and flows seamlessly into action-specific modules—such as uploading documents, validating income logic, or escalating for underwriting—without losing context.

Every stage of the process is supported by visual cues, inline guidance, and system feedback to reduce cognitive load and eliminate ambiguity. By prioritizing task relevance, system clarity, and cross-role consistency, the new flow empowers users to complete their work more accurately, confidently, and efficiently—ultimately improving both the borrower experience and operational throughput.

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

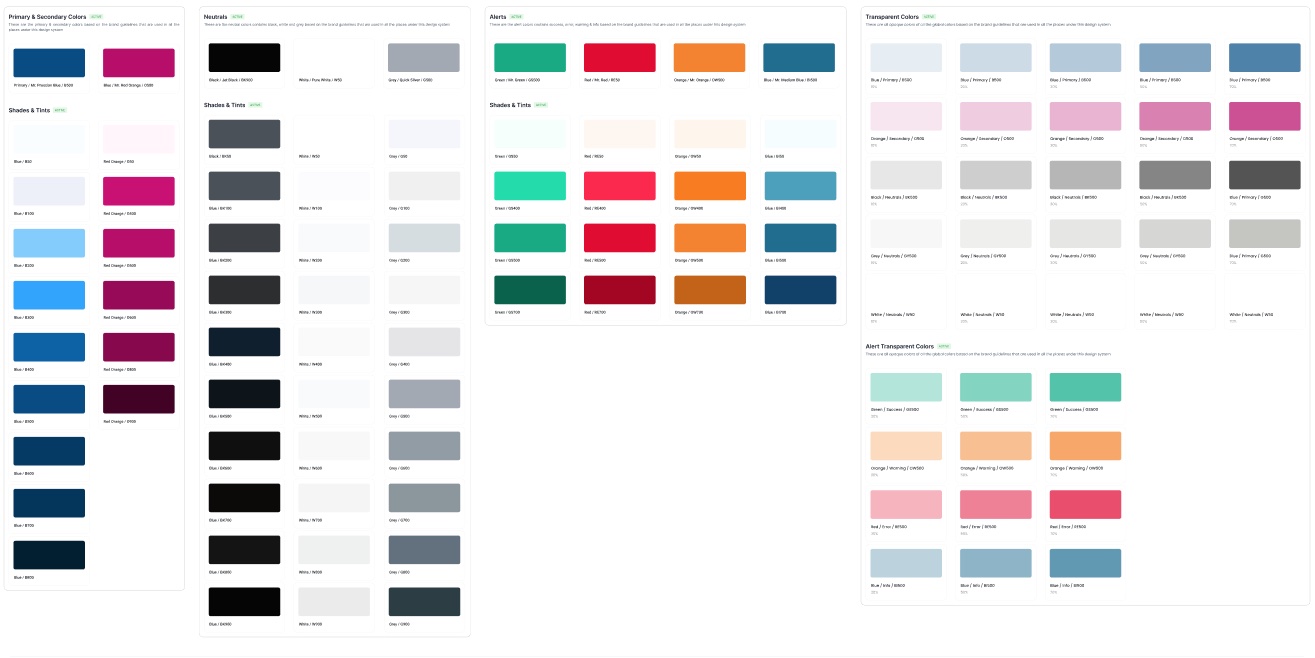

Style & Systems

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

A Complex System Made Simple

To support the WAG tool redesign and future scalability, we developed a modular design system engineered for seamless curation of components and widgets. Each element was crafted to address specific use cases across diverse income types and user roles, ensuring consistent visual hierarchy, interaction patterns, and accessibility compliance. The system allowed us to rapidly assemble interfaces that adapt to real-time input, aligning closely with context-driven workflows. Dynamic heuristics—such as progressive disclosure, guided decision trees, and contextual validation—were embedded into components to help users navigate complex processes with confidence. This system not only ensured design consistency and reusability across the product but also provided the flexibility needed to address high-variance scenarios common in mortgage income assessment.

Allison, or Ally for short, has been in business in the Marketing and Advertising areas for well over 15 years. She's and her company is well known within the Detroit borders. Unfortunately, due to raises in cost and expenses, she is in need of a new office area that is easy to get to, access to parking, and doesn't have a high cost associated. She finds this information needed to gain contacts with owners.

Ideation

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Mood Board

The Visual Process

The moodboard was curated as a targeted visual benchmark, featuring dashboards from multiple industries—including fintech, healthcare, logistics, and enterprise SaaS. Each selection was chosen to address a specific user pain point uncovered during research, serving as a competitive justification for component styles, information hierarchy, and interaction patterns. The dashboards were evaluated against key usability heuristics such as visibility of system status, recognition over recall, and user control. For example, healthcare UIs influenced our approach to high-density data display for Underwriters, while fintech interfaces guided the streamlined input flows for Loan Officers. This cross-industry reference helped inform the design language, ensuring our components were not only visually aligned but functionally optimized for clarity, speed, and confidence across all roles.

Prototyping

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

The New Features

Before & After

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

Old, Left | New, Right... Slide Left/Right to Reveal

Before the redesign, users had to navigate through multiple layers of the WAG tool to access essential account information, often requiring deep dives into individual account levels just to verify income status, documentation completeness, or submission standing. This fragmented experience led to inefficiencies, user frustration, and delays in the loan assessment process.

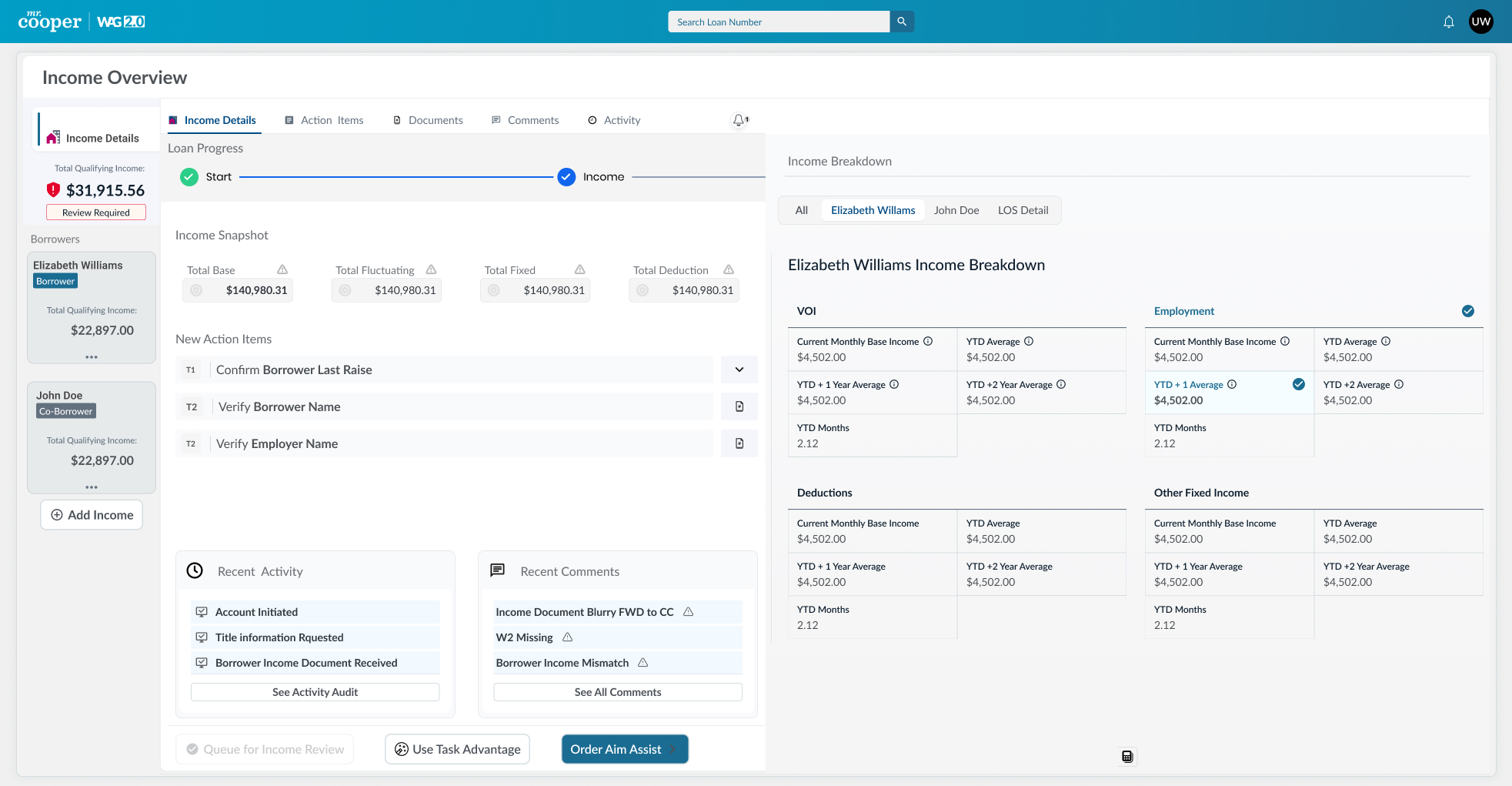

After the redesign, the new UI provides a consolidated, high-level view of account standing right from the main dashboard. Users can now immediately see key indicators—such as document status, income type flags, and outstanding actions—without additional navigation. This broad-view interface aligns directly with user requests and streamlines task prioritization, allowing Sales Associates and Underwriters to act faster and with greater confidence. The improved visibility reduces cognitive load, increases operational efficiency, and enhances decision-making across roles.

NEW AI Search

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

The redesigned search feature introduces an intelligent, AI-powered experience that significantly enhances how users access account data. Previously, users were required to manually pre-filter data to locate specific accounts or borrower details, which often slowed down follow-up efforts and hindered productivity. In the new system, search activates instantly as the user types, eliminating the need for predefined filters.

The AI engine interprets natural language inputs and dynamically matches keywords in real time, delivering highly relevant results across multiple categories. Search results are now intuitively organized into clearly labeled sections—such as property address, loan number, borrower name, or associated company representatives—providing immediate clarity and context. Additionally, a customizable filter pane allows users to fine-tune results further when needed, offering both speed and precision. This new feature transforms account follow-ups from a manual task into a fluid, intelligent interaction, aligning with modern expectations for performance and usability.

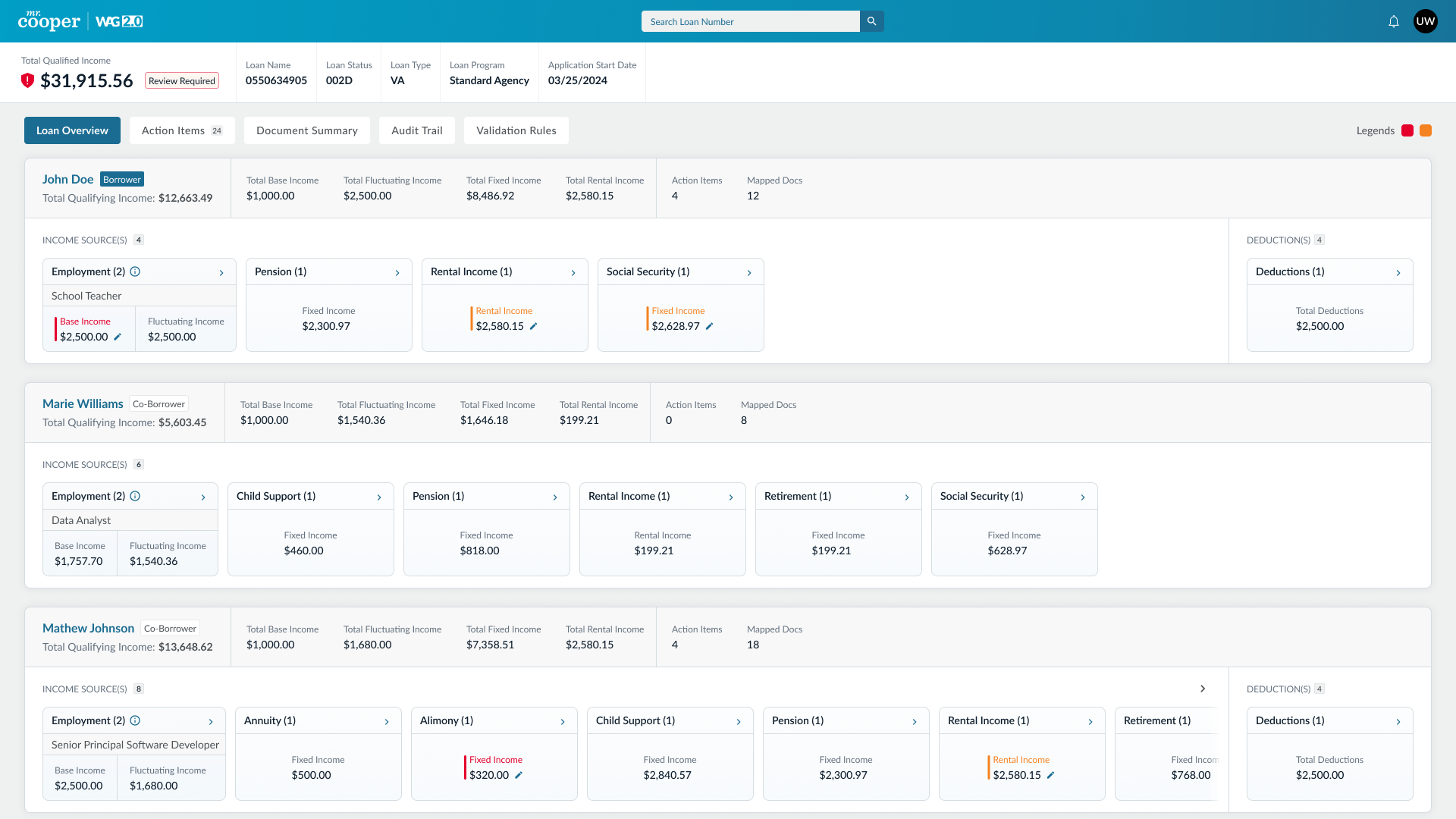

NEW Loan Details View

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

/Intial Search Screen

The redesigned Loan Details View offers a centralized, streamlined workspace that brings together all essential loan information in a single interface. Previously, users had to navigate across multiple screens or systems to gather details like borrower info, income type, and documentation status—often leading to delays and errors. The new view consolidates this data into clearly labeled sections, including borrower details, property address, income verification, loan number, document checklists, and submission timelines.

Visual cues such as progress bars, color-coded statuses, and inline alerts help users quickly identify outstanding actions. Role-based visibility ensures that each user—whether a Mortgage Banker, Loan Officer, or Underwriter—sees the most relevant information for their workflow. Users can now take contextual actions directly within the view, such as uploading documents or initiating communication, improving efficiency, accuracy, and team collaboration.

NEW AI Income Process Guide

Our major desire is that of the user, the customer, leaving our site feeling that they are valued and apreciated.... Even if they have only encountered som basic black on white text. We want their experience to be profound. We want to wow them creating complexities of something simple and transforming something complex into an and easy to grasp minimalism.

The new AI Process Guide is an intelligent, wizard-style workflow designed to walk users step-by-step through the actions required to prepare an account for income review. Replacing the previous manual and disjointed process, this guided experience ensures that all critical steps—such as document collection, income type selection, and submission validation—are completed in the correct order with system-driven clarity.

Integrated within the guide are two key AI-powered features: an embedded AI chatbot that allows users to ask questions at any point for real-time support, and a specialized AI recommendation engine that analyzes user inputs to suggest the most appropriate next actions or flag potential errors before submission. Together, these tools reduce guesswork, improve user confidence, and help streamline the income assessment process across all user roles.

Thanks for Viewing

Check Out Similar Projects